Below are the disclosures and legal agreements that cover your use of our services, including this site. The documents are:

- The Cardholder Agreement, which defines the rights and responsibilities of the account owner and his or her relationship with Sunrise Banks, the financial institution where your funds will be deposited. This agreement includes a disclosure of fees associated with the program, the privacy rights of the cardholder, and a required notice about Patriot Act identity verification.

- The True Link Financial Protection Service Agreement, which defines the administrator's responsibilities to the cardholder, the cardholder's acceptance of the administrator, and their relationship between True Link.

- The e-Sign consent, which enables us to communicate with you electronically.

- The website terms of service, and privacy policy, which every website is required to have to define how you may use the website and how we protect your privacy.

We encourage you to read all of them with care and make sure you fully understand them. If you have any questions, please don't hesitate to contact us or seek independent legal advice.

List of All Fees for ABLE Visa® Prepaid Card (“Fee Schedule”)

| Fee |

Fee Description

Shown on Your Statement |

Fee Amount | Details |

|---|---|---|---|

| Set-Up and Maintenance | |||

| Monthly Fee | Monthly Fee | $5.00 | This fee will be charged on the first day of the month following card activation and monthly thereafter. *This fee is $2.50 for ABLE participants in Florida and $1.25 for ABLE participants in Maryland, Oregon, and Washington. There is no monthly fee for ABLE participants in California. |

| Using your Card outside the U.S. | |||

| International Transaction Fee | International Purchase Fee | $2.00 | This is our fee for an international purchase. If you make a purchase in a currency other than U.S. dollars, the amount deducted from your Card Account will be converted by Visa into U.S. dollars. Visa will establish a currency conversion rate for this convenience using a rate selected by Visa from the range of rates available in wholesale currency markets for the applicable central processing date which may vary from the rate Visa itself receives, or the government-mandated rate in effect for the applicable central processing date, in each instance. This currency conversion fee is in addition to our fee. |

| Other | |||

| Replacement Card | Replacement Card Fee | $5.00 | This is our fee each time you request a replacement card prior to the expiration/valid thru date of your card. |

| Expedited Card | Expedited Shipping Fee | $30.00 | This is our fee each time you request expedited shipping for a card. Your card will arrive in approximately 2-4 business days. You can choose standard delivery of your card for no shipping fee. |

Your funds are eligible for FDIC insurance. Your funds will be held at or transferred to Sunrise Banks N.A., an FDIC-insured institution. Once there, your funds are insured up to $250,000 by the FDIC in the event the Bank fails, if specific deposit insurance requirements are met and we have been able to verify your identity. See fdic.gov/deposit/deposits/prepaid.html for details.

No overdraft/credit feature.

Contact us by calling 1-888-219-9054, by mail at True Link Financial, Inc., PO Box 581, San Francisco, CA 94104, or visit truelinkcard.com/able.

For general information about prepaid accounts, visit

cfpb.gov/prepaid.

If you have a complaint about a prepaid account, call the Consumer Financial Protection Bureau at 1-855-411-2372 or visit

cfpb.gov/complaint.

Cardholder Agreement

This Cardholder Agreement, including the List of All Fees, and any Privacy Notice provided to you by us (collectively referred to as this “Agreement”), sets forth the terms of your True Link ABLE Visa® Prepaid Card. Please read it carefully and retain it for your records. Your Card is issued by Sunrise Banks N.A., Sioux Falls, SD 57108, Member FDIC pursuant to a license from Visa U.S.A., Inc.

IMPORTANT INFORMATION ABOUT PROCEDURES FOR OPENING A CARD ACCOUNT: To help the federal government fight the funding of terrorism and money laundering activities, the USA PATRIOT Act requires all financial institutions and their third parties to obtain, verify and record information that identifies each person who opens a card account. What this means for you: when you open a card account, we will ask for your name, address, date of birth, and other information that will allow us to identify you. We may also ask to see your driver’s license or other identifying documents.

Definitions: In this Agreement, the words “you” and “your” means the Cardholder, Card Owner, Administrator and Authorized User of the Card. “Card Owner” means the person who qualified for the Card Account and owns the funds in the Card Account. “Administrator” means the person authorized by the Card Owner to receive information about the Card Account and to personalize spending actions using the True Link Financial Protection Software Service. “Authorized User” means any person issued a Card at the request of the Card Owner and/or authorized by the Card Owner to use the Card. True Link Financial, Inc. is the service provider that markets and services your Card Account and the True Link Financial Protection Software Service. “Card” means the ABLE Visa Prepaid Card that is issued to you by us. "Card Account" means the custodial sub-account we maintain on your behalf to account for the transactions made with your Card, Card Number or Account Number. “Account Number” means the 11-digit number used to identify your Card Account. “Card Number” means the 16-digit number embossed on your Card. "Business days" are Monday through Friday, excluding federal holidays. Saturday, Sunday, and federal holidays are not considered business days, even if we are open. “PIN” means personal identification number. “Access Information” means collectively your PIN, online user name, password, challenge questions, and any other security information used to access your Card Account. “ABLE Account” means the investment account available to eligible Card Owners through the Achieving a Better Life Experience Act and from which funds may be loaded to the Card

Agreement to Terms: By activating or using your Card (see “Activating Your Card” section), you agree to the terms of this Agreement. If you do not agree to the terms of this Agreement or do not want to use the Card, please destroy the Card at once by cutting it in half and call us at 1-888-219-9054 to cancel your Card Account. When any provision in this Agreement states that we may take certain actions, we may do so in our sole discretion. The terms of this Agreement are subject to amendment at any time in accordance with the “Change in Terms” section.

Prepaid Card: The Card is a prepaid card. The Card allows you to access funds loaded or deposited to your Card Account from your ABLE Account. Your Card Account does not constitute a checking or savings account. Except as a means to access funds deposited from your ABLE Account into your Card Account, your Card is not connected in any way to any other account you may have. The Card is not a gift card, nor is it intended to be used for gifting purposes. The Card is not a credit card and may not provide the same rights to you as those available in credit card transactions. You will not receive any interest on the funds in your Card Account. Subject to applicable law, your Card Account will be insured for the benefit of the Card Owner to the maximum limit provided by the Federal Deposit Insurance Corporation provided we have been able to verify your identity. The Card will remain the property of the Bank, must be surrendered upon demand and is nontransferable.

Activating Your Card: You cannot use the Card until it has been activated. To activate a Card, call 1-888-219-9054 and follow the instructions provided. As part of the activation, you may be required to provide your Social Security Number and date of birth. Although no credit history is required to obtain a Card, you authorize us to obtain information about you from time to time from credit reporting agencies, your employers and other third parties for our internal processes.

Administrator: The True Link Financial Protection Software Service (governed by the True Link Financial Protection Software Services Agreement) offered in connection with your ABLE Visa Prepaid Card permits you to authorize another person (“Administrator”) to obtain information about your Card Account, take certain administrative actions with respect to your Card Account and assist you in personalizing your spending actions or limitations. By way of example, and without limitation, the True Link Financial Service permits your designated Administrator to view past Card transactions, define rules for declining certain types of future Card transactions, receive alerts about transactions initiated with your Card, dispute transactions, initiate action to close your Card Account and transfer out the funds, order an additional or replacement Card, arrange for the deposit of your funds to your Card Account, initiate bill payment if a bill payment service is available, and generally administer your Card Account. We do not monitor the activities of any Administrator and cannot verify the intentions or trustworthiness of your Administrator. You should not authorize an Administrator to act on your behalf unless you are willing to grant such person administration rights over your Card Account.

Liability for Acts of Administrators: If you permit another person to have access to your Card, Card Number or Account Number, including Administrators, you are liable for all transactions made with the Card, Card Number or Account Number, and all related fees incurred by those persons. You must notify us by calling 1-888-219-9054 or emailing ablecard@truelinkfinancial.com to revoke permission for any person you previously authorized to use your Card or serve as an Administrator of your Card Account. Until we have received your revocation notice and have had a reasonable time to act on it, you are responsible for all transactions and fees incurred by you or any other person you have authorized to use or access your Card or Card Account. If you tell us to revoke another person’s use of your Card or access to your Card Account, we may revoke your Card and issue a new Card with a different Card Number and/or Account Number. You are wholly responsible for the use of each Card according to the terms of this Agreement.

Using Your Card: After you receive your Card, you may use it to purchase goods and services everywhere Visa debit cards are accepted or to withdraw cash from your Card Account if your state ABLE program has enabled cash access (see “Using Your Card to Get Cash”). You acknowledge that because the funds in your Card Account have been transferred from your ABLE Account, the terms and conditions of your ABLE Account may apply to limit the purposes for which you may use your Card funds. Please see your ABLE Account terms and conditions for more details regarding qualified expenses and purchases. If you do not have enough funds loaded on your Card, you can instruct the merchant to charge a part of the purchase to the Card and pay the remaining amount with other funds. These are called “split transactions,” and some merchants do not permit them. Each time you use the Card to purchase goods or services, obtain cash or initiate another type of funds transfer authorized by this Agreement, you authorize us to reduce the value available on the Card by the amount of the transaction plus applicable fees.

You agree that you will: (i) not use the Card at gambling websites or to purchase illegal goods or services; (ii) promptly notify us of any loss or theft of the Card; (iii) promptly notify us of the loss, theft, or unauthorized disclosure of any Access Information used to access the Card Account information or Card funds; (iv) not use the Card for business purposes; and (v) use the Card only as permitted by us. We may refuse to process any transaction that we believe violates the terms of this Agreement, is suspicious or fraudulent, or exceeds any settings you or your Administrator have established for your Card Account. Although we will use commercially reasonable efforts to decline any transactions you or your Administrator have specifically requested us to decline in your Card Account settings, we do not guarantee that we will be able to decline or prevent these transactions in all circumstances or at all merchants and we shall not be liable in the event you initiate and we authorize a transaction that exceeds your Card Account settings. By agreeing to these terms and conditions, you agree to the restrictions that you set on the Card.

PIN: A PIN is a four-digit code that may be used to make purchase transactions. Some merchants may require you to make purchases using a PIN rather than your signature. Only one (1) PIN will be issued for the Card. To prevent unauthorized access to the Card balance, you agree to keep your PIN confidential. We recommend that you memorize your PIN and do not write it down. You can call 1-888-219-9054 to reset your PIN.

Limitations on Card Usage: Use of your Card is subject to the limitations set forth below, and no transaction may exceed the value available in your Card Account. For security reasons, we may further limit the amount or number of transactions you can make with your Card on a daily or monthly basis, or in the aggregate, and we may limit the dollar amount of transactions to or from your Card Account. We may increase or decrease these limits or add additional limits from time to time in our sole discretion without prior notice to you except as required by law.

| Limitation Type |

Frequency and/or Dollar Limits

(for typical transactions) |

|---|---|

| Card Limits | |

| Maximum Card Account balance | $20,000.00 total |

| Load Limits | |

| Cash Loads | Not allowed |

| Direct Deposits/Transfers from Your ABLE Account - Daily | $5,000.00 total per day |

| Direct Deposits/Transfers from Your ABLE Account - Monthly | $20,000.00 total per month |

| Spend Limits | |

| Cash Withdrawals (ATM or POS) | Not allowed |

| Cash Withdrawal (Over the Counter or Quasi Cash) | Not allowed |

| Card Purchases (Signature & PIN) - daily | $5,000.00 total per day |

| Card Purchases (Signature & PIN) - Monthly | $20,000.00 total per month |

* ATM withdrawals and related limits apply only if your state ABLE program has enabled cash access. If your program does not offer cash access, ATM withdrawals are not allowed. You can confirm availability with your program administrator.

Loading Your Card Account: You may arrange to have transfers made to your Card Account from your ABLE Account. Your ABLE Account is the only source of funds for a transfer onto your ABLE Visa Prepaid Card. You can call us at 1-888-219-9054 to find out whether or not the any transfer has been made to your Card.

ONLY TRANSFERS FROM YOUR ABLE ACCOUNT WILL BE ACCEPTED. NO OTHER LOAD TYPES ARE ALLOWED FOR THIS CARD, INCLUDING CASH LOADS AND LOADS THROUGH RETAIL LOAD NETWORKS (e.g. GreenDot, MoneyGram, Western Union, etc.).

Using Your Card for Purchases: When you use your Card Account to pay for goods or services, certain merchants may ask us to authorize the transaction in advance and may estimate its final value. When we authorize the transaction, we commit to make the requested funds available when the transaction finally settles and may place a temporary hold on your Card’s funds for the amount indicated by the merchant (which may be more than the final settled transaction amount). If you use your Card at a restaurant, a hotel, for a car rental purchase, or for similar purchases, the merchant may preauthorize the transaction amount for the purchase amount plus up to 20% more to ensure there are sufficient funds available to cover tips or incidental expenses incurred. Transactions at certain merchants that authorize high dollar amounts, especially rental car companies and hotels, may cause an “authorization” or “hold” on your available balance for up to thirty (30) days. Until the transaction finally settles or we determine that it is unlikely to be processed, the funds subject to the hold will not be available to you for other purposes. We will only charge your Card Account for the correct amount of the final transaction, however, and will release the hold on any excess amount when the transaction finally settles.

Using Your Card to Get Cash: If your state ABLE program has enabled cash access, you may use your Card and PIN to obtain cash at ATMs displaying the Visa or Allpoint Brand Mark, or at merchants that have agreed to provide cash back with a PIN purchase, subject to the limitations in the section “Limitations on Card Usage”. ATM and PIN purchase cash withdrawals are limited to the available balance in your Card Account. Merchants and ATM operators may have additional limitations. You may be charged a fee by us for each cash withdrawal and balance inquiry made at an ATM in the amount disclosed (see “List of All Fees” above for applicable fees). In addition, when you use an ATM not owned by us, you may be charged a fee by the ATM operator or any network used. ATM access is not available in all state ABLE programs. Please check with your program administrator to confirm whether cash access is available for your card.

Negative Balance: You acknowledge and agree that the value available in your Card Account is limited to the funds that have been loaded to your Card Account by you or on your behalf. Each time you initiate a Card transaction, you authorize us to reduce the funds available in your Card Account by the amount of the transaction and all associated transaction fees. You are not allowed to exceed the available amount in your Card Account through an individual transaction or a series of transactions (creating a “negative balance”). Nevertheless, if any transactions or transaction fees cause the balance in your Card Account to go negative, including any purchase transactions where the retailer or merchant does not request authorization, you shall remain fully liable to us for the amount of any negative balance and any corresponding transaction fees. We do not extend credit, so if your Card Account becomes overdrawn, you agree to pay us the overdrawn amount immediately, without further demand. We may deduct the overdraft amount from any current or future funds on this or any other Card Account you activate or maintain with us. If your Card Account has a zero or negative balance, we may, at our option, cancel your Card Account without notice.

Preauthorized Payments from Your Card: You may preauthorize a merchant to make recurring electronic funds transfers from your Card Account. If these regular payments may vary in amount, the person you are going to pay will tell you ten (10) days before the payment is due when it will be deducted from your Card Account value and how much it will be. If you have told us in advance to make regular, recurring payments from your Card Account, you can stop any of these payments by calling us at 1-888-219-9054, emailing us at ablecard@truelinkfinancial.com, or writing to us at True Link Financial, Inc., PO Box 581, San Francisco, CA 94104 in time for us to receive your request at least three (3) business days or more before the payment is scheduled to be made. If you call, we may also require you to put your request in writing and get it to us within fourteen (14) days after you call.If you order us to stop one of these payments three (3) business days or more before the transfer is scheduled, and we do not do so, we will be liable for your losses or damages.

Refunds for Purchases Made with the Card: Any refund for goods or services purchased with the Card Account will be made in the form of a credit to the Card. You are not entitled to receive a cash refund.

Disputes with Merchants: We are not responsible for the delivery, quality, safety, legality or any other aspect of goods and services that you purchase from others with a Card. All such disputes should be addressed to the merchants from whom the goods and services were purchased.

Reversal: Point of sale transactions cannot be reversed. If you authorize a transaction and then fail to make a purchase of that item as planned, the approval may result in a hold of funds equal to the estimated purchase amount, for up to seven (7) days.

List of All Fees: We will charge you, and you agree to pay, the fees and charges set forth in the “List of All Fees”. You may also log in at www.truelinkcard.com to view a complete list of fees. We generally deduct fees and charges from the Card Account at the time a fee or charge is incurred. If you request a service that is not included (see “List of All Fees” for applicable fees), if there is a fee for such service it will be disclosed at that time, and you agree that any such fee may be deducted from your Card Account.

Liability for Use of Card Funds. The Bank is not the issuer or holder of your ABLE Account and has no responsibility or liability for how you spend the money on your Card, including if funds are spent on non-qualified ABLE withdrawals that have tax or benefits eligibility implications. You are solely responsible for complying with the terms and conditions of your ABLE Account, and you agree to indemnify, defend and hold the Bank harmless against any and all losses, expenses, penalties, or fines arising from any legal action, claim, demand, or proceeding brought by any third party relating to the ABLE Account program or your use of ABLE Account funds.

Card Account Balance and Transaction History: You can obtain information about the current available balance in your Card Account at no charge by calling 1-888-219-9054. You may also obtain your balance information, along with a history of your account transactions, at no charge by logging into your Card Account online. You also have the right to obtain a written history of account transactions by calling 1-888-219-9054 or by writing us at True Link Financial, Inc., PO Box 581, San Francisco, CA 94104.

Foreign Transactions: If you obtain your funds (or make a purchase) in a currency other than U.S. dollars, the amount deducted from your Card Account will be converted by Visa into U.S. dollars. Visa will establish a currency conversion rate for this convenience using a rate selected by Visa from the range of rates available in wholesale currency markets for the applicable central processing date which may vary from the rate Visa itself receives, or the government-mandated rate in effect for the applicable central processing date, in each instance. Fees may apply for foreign transactions (see “List of All Fees” for applicable fees).

Change in Terms: Subject to the requirements and limitations of applicable law, we may at any time add to, delete or change the terms of this Agreement without advance notice to you except as required by law. Advance notice may not be given if we need to make the change immediately in order to maintain or restore the security of your Card or Card Account or any related payment system.

Cancellation and Suspension: We reserve the right, in our sole discretion, to limit your use of the Card. We may refuse to issue a Card Account or may revoke Card Account privileges with or without cause or notice, other than as required by applicable law. If you would like to cancel the use of your Card, contact us at 1-888-219-9054 or visit truelinkcard.com/able. You agree not to use or allow others to use an expired, revoked, cancelled, suspended or otherwise invalid Card. Our cancellation of Card Account privileges will not otherwise affect your rights and obligations under this Agreement. If we cancel or suspend your Card Account privileges through no fault of yours, you will be entitled to a refund of any remaining balance, as provided in this Agreement. Funds will be provided by check, made payable to the Card Owner. We may additionally offer you the option of a refund by card-to-bank transfer at our discretion.

Card Expiration/Settlement: Subject to applicable law, you may use the Card only through its expiration date, which is stated on the front of the Card. If you attempt to use the Card or add funds to your Card Account after the expiration date, the transactions may not be processed. If there is a balance remaining in your Card Account upon expiration, a new Card may be issued to you. You must activate any newly issued Card in order to access the funds in your Card Account. If we do not choose to issue a new Card to you or if we cancel your Card Account for any reason, we will attempt to refund to the Card Owner the balance remaining in your Card Account less any amounts owed to us (e.g., fees and charges) via a check made payable to the Card Owner.

Unclaimed Property: You acknowledge and agree that we may be required by applicable law to turn over to a state government authority any funds remaining on your Card Account after a period of inactivity or dormancy. Card funds in Card Accounts will be remitted to the custody of the applicable state agency in accordance with state law, and we will have no further liability to you for such funds unless otherwise provided by law. If this occurs, we may try to locate the Cardh Owner at the address shown in our records, so we encourage you to keep us informed if you change your address. You may notify us of a change of address by calling Customer Service at 1-888-219-9054 or visit truelinkcard.com/able.

Information Given to Third Parties: We may disclose information (including personally identifiable information) to third parties about you, the Card, your Card Account and the transactions related to the Card or Card Account: (i) where it is necessary or helpful for completing a transaction; (ii) in order to verify the existence and condition of the Card or Card Account for a third party (e.g., a merchant); (iii) in order to comply with any law or to comply with requirements of any government agency or court order; (iv) if you give us your written consent; (v) to service providers who administer the Card or the Card Account or perform data processing, records management, collections, and other similar services for us, in order that they may perform those services; (vi) in order to prevent, investigate or report possible illegal activity; (vii) in order to issue authorizations for transactions on the Card; (viii) in accordance with our Privacy Policy; and (ix) as otherwise permitted by law. Information Security: Only those persons who need it to perform their job responsibilities are authorized to have access to Cardholder Information. In addition, we maintain physical, electronic, and procedural security measures that comply with federal regulations to safeguard Cardholder Information. Please see our Privacy Policy for further details.

We are required to periodically report certain Card information to the Visa Prepaid Clearinghouse Service (PCS) to assist in fraud prevention. Please contact PCS Customer Service for details regarding the information reported and on file with PCS.

Visa PCS Customer Service Department

P.O. Box 4000

Conway, AR 72033

Phone (844) 263-2111

Fax (844) 432-3609

PCS Customer Service Department’s business hours are Monday – Friday, 9:00 a.m. – 5:00 p.m. Eastern Time.

Website Availability: Although considerable effort is expended to make the website and other means of communications and access available around the clock, we do not warrant that these forms of access will be available and error free at all times. You agree that we will not be responsible for temporary interruptions in service due to maintenance, website changes, or failures, nor shall we be liable for extended interruptions due to failures beyond our control, including but not limited to the failure of interconnecting and operating systems, computer viruses, forces of nature, labor disputes and armed conflicts. We shall not be responsible to you for any loss or damages suffered by you as a result of the failure of systems and software used by you to interface with our systems or systems and software utilized by you to initiate or process banking transactions, whether such transactions are initiated or processed directly with our systems or through a third party service provider. You acknowledge that you are solely responsible for the adequacy of systems and software utilized by you to process banking transactions and the ability of such systems and software to do so accurately.

Protecting Your Access Information: To prevent unauthorized access to your Card and Card Account, you agree to keep your Access Information confidential. We recommend that you memorize your Access Information and do not write it down. If you believe the security of your Access Information has been compromised in any way (for example, your password has been lost or stolen, someone has attempted to use our website under your user name without your consent, or your Card has been accessed), you must notify us immediately. Under certain circumstances, we may deny your access to our website in order to maintain or restore security or performance of the website. We may do so if we reasonably believe your Access Information has been or may be obtained or is being or may be used by an unauthorized person. We may try to notify you in advance but cannot guarantee we will do so.

How to Notify Us of Lost or Stolen Card, PIN or Unauthorized Transfers: If you believe your Card or any other Access Information has been lost or stolen, immediately call: 1-888-219-9054 or write: True Link Financial, Inc., PO Box 581, San Francisco, CA 94104. You should also immediately call the number or write to the address listed above if you believe a transfer has been made using the information from your Card or Access Information without your permission.

Your Liability for Unauthorized Transfers. Tell us immediately if you believe your Card or Access Information has been lost or stolen or if you believe that an electronic funds transfer has been made without your permission. Telephoning us at 1-888-219-9054 is the best way to minimize your possible losses. You could lose all the money in your Card Account. You agree that any unauthorized use does not include use by a person to whom you have given authority to use or access your Card Account or Access Information and that you will be liable for all such uses and funds transfers by such person(s).

If you tell us within two (2) business days after you learn of the loss or theft of your Card or Access Information you can lose no more than $50 if someone used your Card or Access Information without your permission. If you do NOT tell us within two (2) business days after you learn of the loss or theft of your Card or Access Information and we can prove we could have stopped someone from using your Card or Access Information without your permission if you had told us within this time frame, you could lose as much as $500 if someone used your Card or Access Information without your permission.

Also, if your electronic history shows transactions that you did not make, including those made by Card, Access Information or by other means, tell us immediately. If you do not tell us within 60 days after your account statement was made available to you, you may not get back any money you lost after this period if we can prove that we could have stopped someone from taking the money if you had told us in time. If a good reason (such as a long trip or a hospital stay) kept you from learning of the unauthorized transaction and telling us, we will extend the time periods for a reasonable period in our sole discretion.

Additional Limits on Liability Visa Rules.

Under Visa rules, unless you have been grossly negligent or have engaged in fraud you will not be liable for any unauthorized transaction using your lost or stolen card. This additional limit on liability does not apply to ATM transactions or to transactions using your PIN which are not processed by Visa.

Our Liability for Failing to Make Transfers. If we do not complete a transaction to or from your Card Account on time or in the correct amount according to our Agreement with you, we may be liable for your losses or damages. However, there are some exceptions. We will not be liable, for instance:

- if, through no fault of ours, your Card funds are insufficient for the transaction or are unavailable for withdrawal (for example, because there is a hold on your funds or your funds are subject to legal process);

- if a computer system, or POS terminal was not working properly and you knew about the problem when you started the transaction;

- if a merchant refuses to honor your Card;

- if circumstances beyond our control (such as fire, flood, pandemic, terrorist attack or national emergency) prevent the transaction, despite reasonable precautions that we have taken;

- if any failure or malfunction is attributable to your equipment, to merchant or ATM equipment, or to any internet service or payment system;

- if you attempt to use a Card that has not been properly activated;

- If your Card or Access Information has been reported as lost or stolen, if your Card Account has been suspended by us, or we believe the transaction is not authorized by you;

- If you or your Administrator have specifically requested us to decline certain transactions in your Card Account settings; or

- As otherwise provided in this Agreement.

Information About Your Right to Dispute Errors: In case of errors or questions about your Card Account, please contact us as soon as possible at 1-888-219-9054 or write to us at True Link Financial, Inc., PO Box 581, San Francisco, CA 94104 We must allow you to report an error until 60 days after your account statement was made available to you for the transfer that was credited or debited to your Card Account allegedly in error. You may request a written history of your transactions at any time by contacting us at the telephone number or address above. You will need to tell us: (1) your name; (2) your Card Number, (3) why you believe there is an error, (4) the dollar amount involved, and (5) approximately when the error took place. If you tell us orally, we may require that you send us your complaint or question in writing within ten (10) business days. We will determine whether an error occurred within ten (10) business days after we hear from you and will correct any error promptly. If we need more time, however, we may take up to forty-five (45) days to investigate your complaint or question. If we decide to do this, we will provisionally credit your Card Account within ten (10) business days for the amount you think is in error, so that you will have the money during the time it takes us to complete our investigation. If we ask you to put your complaint or question in writing and we do not receive it within ten (10) business days, we may not credit your Card Account. For errors involving new accounts, point-of-sale, or foreign-initiated transactions, we may take up to ninety (90) days to investigate your complaint or question. For new accounts, we may take up to twenty (20) business days to provisionally credit your Card Account for the amount you think is in error. We will tell you the results within three (3) business days after completing our investigation. If we decide that there was no error, we will send you a written explanation. You may ask for copies of the documents that we used in our investigation. If you need more information about our error-resolution procedures, call us at the telephone number shown above.

Questions: True Link Financial, Inc. as the third party that administers the Card program, is responsible for customer service and for resolving any errors in transactions made with your Card. If you have questions regarding your Card, you may call us at 1-888-219-9054 or write True Link Financial, Inc., PO Box 581, San Francisco, CA 94104.

Communications: We may contact you from time to time regarding your Card Account. We may contact you in any manner we choose unless the law says that we cannot. For example, we may:

- contact you by mail, telephone, email, fax, recorded message, text message, or email;

- contact you by using an automated dialing or similar device (“Autodialer”);

- contact you at your home and at your place of employment;

- contact you on your mobile telephone;

- contact you at any time, including weekends and holidays;

- contact you with any frequency;

- contact either you or your Administrator, at our option, about any matter;

- leave prerecorded and other messages on your answering machine/service and with others; and

- identify ourselves, your relationship with us and our purpose for contacting you even if others might hear or read it.

Our contacts with you about your Card Account are not unsolicited and might result from information we obtain from you or others. We may monitor or record any conversation or other communication with you. Unless the law says we cannot, we may suppress caller ID and similar services when contacting you regarding your card. When you give us your mobile telephone number, we may contact you at this number using an Autodialer and can also leave prerecorded and other messages. If you ask us to discuss your Card Account with someone else, you must provide us with documents that we ask for and that are acceptable to us.

Change of Address: If any of your contact information changes (e.g., physical address, mailing address, email address, phone number, or your name), you must notify us immediately. Failure to do so may result in information regarding the Card or Card Account being mailed to the wrong person or your transactions being declined. In such event, we shall not be responsible for any resulting misuse of funds available in the Card Account. Any notice given by us shall be deemed given to you if mailed to you at the last U.S. mail address or electronically delivered to the last email address for the Card Account furnished by you. You agree that we may accept changes of address from the U.S. Postal Service. You also agree that if you attempt to change your address to a non-U.S. address, your Card Account may be cancelled, and funds returned to you in accordance with this Agreement.

Governing Law, Court Proceedings, Damages, Arbitration: Except as set forth in the Waiver of Jury Trial and Arbitration Agreement below, (1) this Agreement will be governed by, construed and enforced in accordance with federal law and the laws of the State of Minnesota; (ii) any action or proceeding with respect to this Agreement or any services hereunder shall be brought only before a federal or state court in the State of Minnesota; and (iii) you agree to pay upon demand all of our costs and expenses incurred in connection with the enforcement of this Agreement. If we are served garnishments, summonses, subpoenas, orders or legal processes of any type, we are entitled to rely on the representations therein and may comply with them in our own discretion without regard to jurisdiction.

ARBITRATION AGREEMENT AND WAIVER OF JURY TRIAL: PLEASE READ THIS PROVISION OF THE AGREEMENT CAREFULLY. UNLESS YOU EXERCISE YOUR RIGHT TO OPT-OUT OF ARBITRATION IN THE MANNER DESCRIBED BELOW, YOU AGREE THAT ANY DISPUTE WILL BE RESOLVED BY BINDING ARBITRATION. ARBITRATION REPLACES THE RIGHT TO GO TO COURT, INCLUDING THE RIGHT TO HAVE A JURY TRIAL, TO ENGAGE IN DISCOVERY (EXCEPT AS MAY BE PROVIDED FOR IN THE ARBITRATION RULES), AND TO PARTICIPATE AS A REPRESENTATIVE OR MEMBER OF ANY CLASS OF CLAIMANTS OR IN ANY CONSOLIDATED ARBITRATION PROCEEDING OR AS A PRIVATE ATTORNEY GENERAL. OTHER RIGHTS THAT YOU WOULD HAVE IF YOU WENT TO COURT MAY ALSO BE UNAVAILABLE IN ARBITRATION.

Agreement to Arbitrate: You and we (defined below) agree that any Dispute (defined below) will be resolved by Arbitration. This agreement to arbitrate is governed by the Federal Arbitration Act, 9 U.S.C. § 1 et seq., and the substantive law of the State of Minnesota (without applying its choice-of-law rules).

What Arbitration Is: "Arbitration" is a means of having an independent third party resolve a Dispute. A "Dispute" is any claim or controversy of any kind between you and us. The term Dispute is to be given its broadest possible meaning and includes, without limitation, all claims or demands (whether past, present, or future, including events that occurred prior to your application for a Sunrise Banks account or Card and whether or not a Sunrise Banks Visa Card is provided to you, based on any legal or equitable theory (contract, tort, or otherwise) and regardless of the type of relief sought (i.e., money, injunctive relief, or declaratory relief). A Dispute includes, by way of example and without limitation, any claim based upon a federal or state constitution, statute, ordinance, regulation, or common law, and any issue concerning the validity, enforceability, or scope of this arbitration agreement.

For purposes of this arbitration agreement, the terms "you" and "your" include any Administrator, Cardholder, Authorized User, co-signer, co-obligor, or guarantor and also your heirs, guardian, personal representative, or trustee in bankruptcy. For purposes of this Agreement, the terms "we," "our," and "us" mean the Bank, True Link Financial, Inc. and their respective employees, officers, directors, members, managers, attorneys, affiliated companies, predecessors, and assigns as well as the marketing, servicing, and collection representatives and agents of either or both.

How Arbitration Works: If a Dispute arises, the party asserting the claim or demand must initiate arbitration, provided you or we may first try to resolve the matter informally or through customary business methods, including collection activity. The party filing an arbitration complaint must choose either of the following arbitration firms for initiating and pursuing arbitration: The American Arbitration Association ("AAA") or JAMS, The Resolution Experts. If the parties mutually agree, a private party, such as a retired judge, may serve as the arbitrator. If you claim you have a Dispute with us, but do not initiate arbitration or select an arbitrator, we may do so. You may obtain copies of the current rules of each of the arbitration firms and forms and instructions for initiating arbitration by contacting them as follows:

American Arbitration Association

Web site: www.adr.org

Telephone (800) 778-7879

JAMS, The Resolution Experts

Web site: www.jamsadr.com

Telephone (949) 224-1810 or (800) 352-5267

In the event both AAA and JAMS are unavailable to decide a Dispute, the parties agree to select another neutral party experienced in financial matters to decide the Dispute. If such an independent arbitrator cannot be found, the parties agree to submit any Dispute to a state or federal judge, sitting without a jury, for resolution on an individual and not a class-wide basis.

The policies and procedures of the selected arbitration firm will apply provided such policies and procedures are consistent with this arbitration agreement. To the extent the arbitration firm's rules or procedures are different than the terms of this arbitration agreement, the terms of this arbitration agreement will apply.

What Arbitration Costs: No matter which party initiates the arbitration, we will advance or reimburse filing fees and other costs or fees of arbitration, provided each party will be initially responsible for its own attorneys' fees and related costs. Unless prohibited by law, the arbitrator may award fees, costs, and reasonable attorneys' fees to the party who substantially prevails in the arbitration.

Location of Arbitration: Unless you and we agree to a different location, the arbitration will be conducted in the county where you reside.

Waiver of Rights: You are waiving your right to a jury trial, to have a court decide your Dispute, to participate in a class action lawsuit, and to certain discovery and other procedures that are available in a lawsuit. You and we agree that the arbitrator has no authority to conduct class-wide arbitration proceedings and is only authorized to resolve the individual Disputes between you and us. The validity, effect, and enforceability of this waiver of class action lawsuit and class-wide arbitration, if challenged, are to be determined solely by a court of competent jurisdiction and not by the AAA, JAMS, or an arbitrator. If such court refuses to enforce the waiver of class-wide arbitration, the Dispute will proceed in court and be decided by a judge, sitting without a jury, according to applicable court rules and procedures, and not as a class action lawsuit. The arbitrator has the ability to award all remedies available by statute, at law, or in equity to the prevailing party.

Applicable Law and Review of Arbitrator's Award: The arbitrator shall apply applicable federal and Minnesota substantive law and the terms of this Agreement. The arbitrator must apply the terms of this arbitration agreement, including without limitation the waiver of class-wide arbitration. The arbitrator shall make written findings and the arbitrator's award may be filed with any court having jurisdiction. The arbitration award shall be supported by substantial evidence and must be consistent with this Agreement and with applicable law, and if it is not, it may be set aside by a court. The parties shall have, in addition to the grounds referred to in the Federal Arbitration Act for vacating, modifying, or correcting an award, the right to judicial review of (a) whether the findings of fact rendered by the arbitrator are supported by substantial evidence and (b) whether the conclusions of law are erroneous under the substantive law of Minnesota and applicable federal law. Judgment confirming an award in such a proceeding may be entered only if a court determines that the award is supported by substantial evidence and is not based on legal error under the substantive law of Minnesota and applicable federal law.

Survival: This arbitration provision shall survive: (1) cancellation, payment, charge-off, or assignment of this Agreement; (2) the bankruptcy of any party; and (3) any transfer, sale, or assignment of this Agreement, or any amounts owed under this Agreement, to any other person or entity.

Right to Opt-Out: If you do not wish to agree to arbitrate all Disputes in accordance with the terms and conditions of this section, you must advise us in writing at the following address by either hand delivery or a letter postmarked within thirty (30) days following the date you enter into this Agreement. You may opt-out without affecting your application or cardholder status

Sunrise Banks

5105 S Crossing Pl, Unit 1A

Sioux Falls, SD 57108

Assignability: We may assign or transfer our rights and obligations under this Agreement at any time without prior notice to you. The Card Account established under this Agreement is not assignable or transferable by you. Notwithstanding the foregoing, this Agreement shall be binding on you, your Authorized Users and Administrators, your heirs, your executors, administrators, guardians, personal representatives, or trustee in bankruptcy.

Miscellaneous Provisions: We do not waive our rights by delaying or failing to execute them at any time. To the extent permitted by law and as permitted by the Waiver of Jury Trial and Arbitration above, you agree to be liable to us for any loss, costs, or expenses that we may incur as a result of any dispute or legal proceeding involving your Account. If a court finds any provision of this Agreement invalid or unenforceable, such finding shall not make the rest of this Agreement invalid or unenforceable. To the fullest extent possible, any such provision shall be deemed to be modified so as to be rendered enforceable or valid; however, if such provision cannot be so modified, it shall be stricken and all other provisions of this Agreement in all other respects shall remain valid and enforceable.

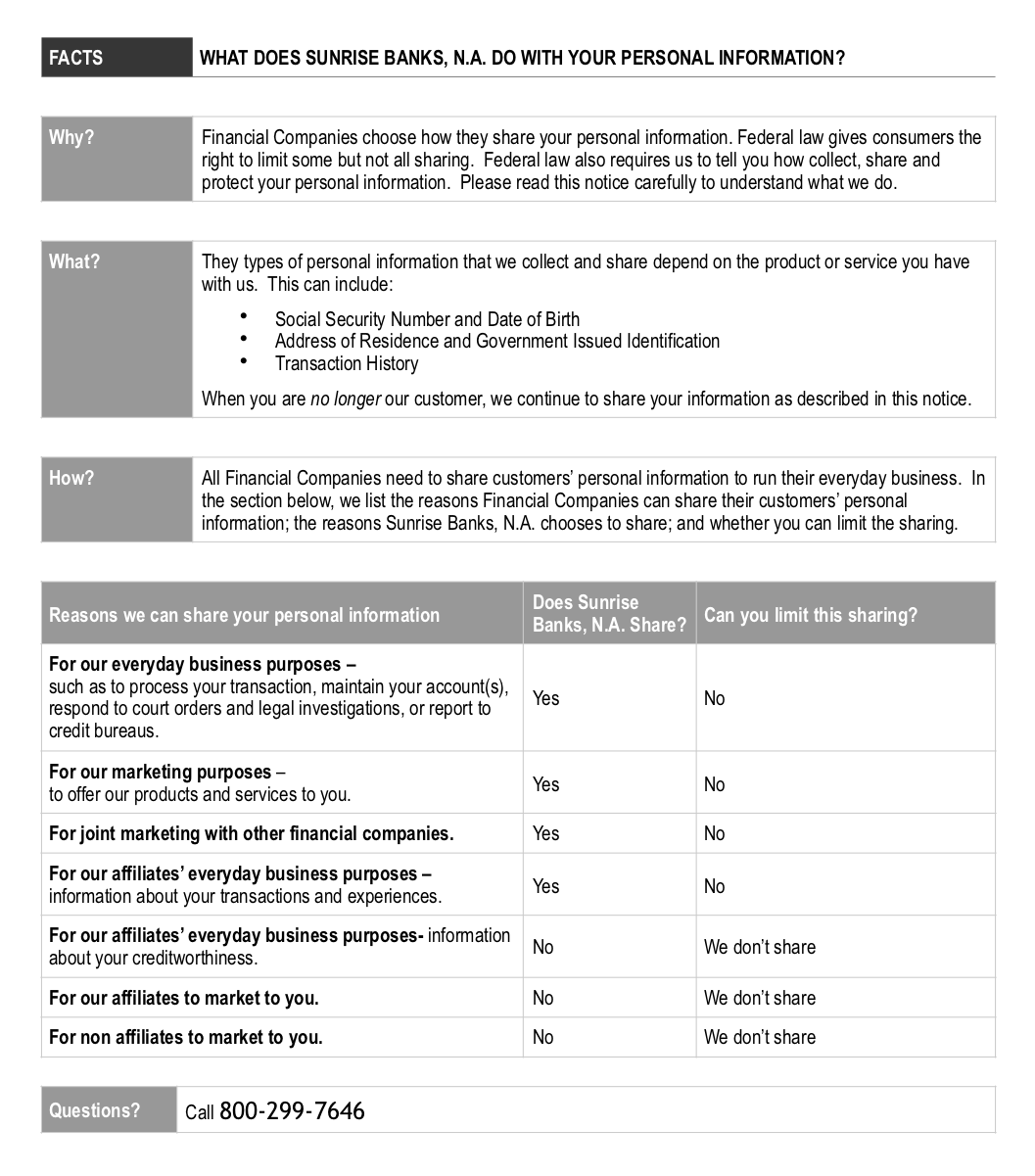

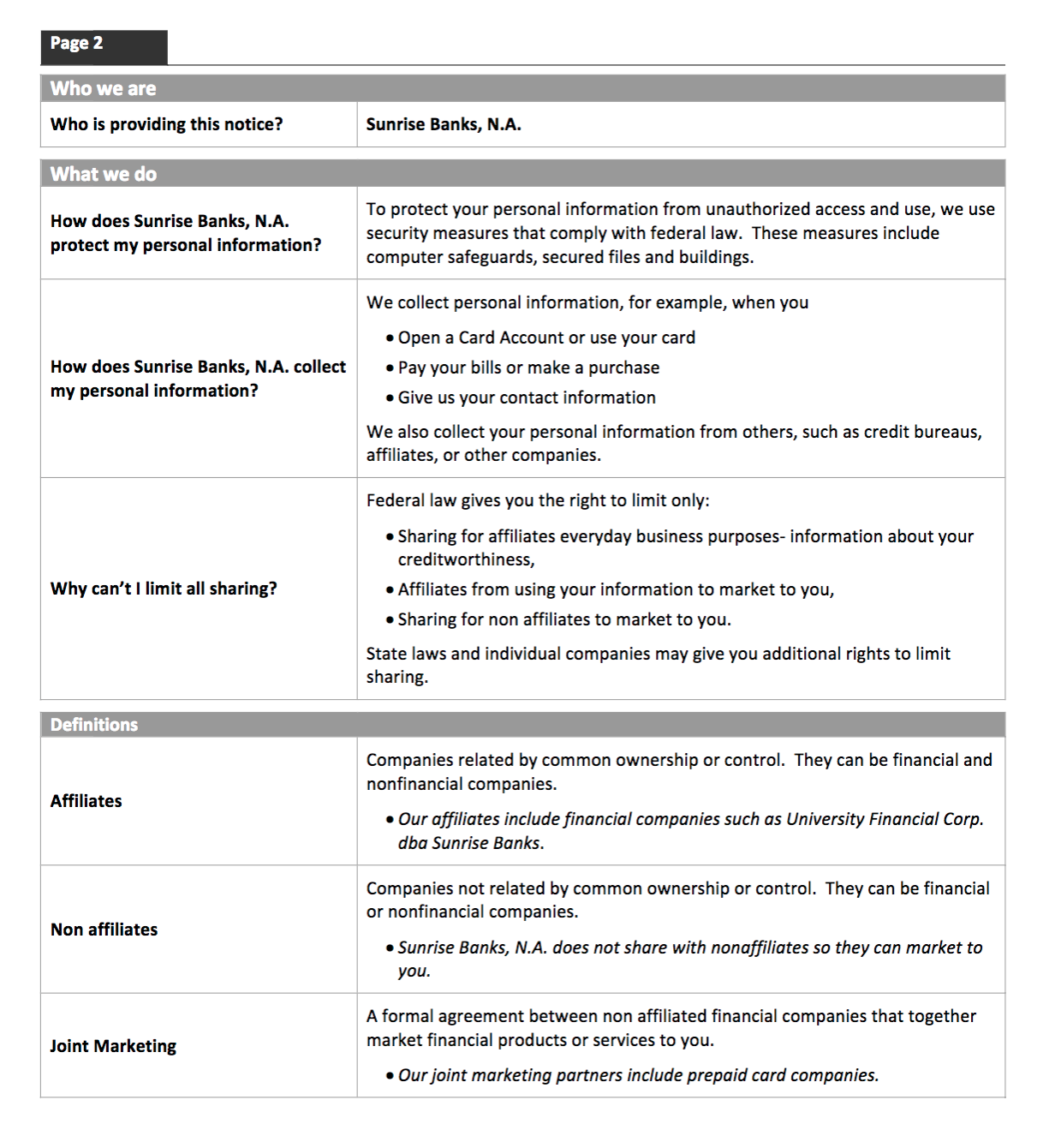

Sunrise Banks Privacy Notice

Esign Consent

Electronic Communication Delivery Policy (E-Sign Disclosure and Consent)

This policy describes how True Link Financial, Inc. (“True Link”) delivers communications to you electronically. We may amend this policy at any time, as set forth in the True Link User Agreement

Electronic delivery of communications

You agree and consent to receive electronically all communications, agreements, documents, notices and disclosures (collectively, "Communications") that we provide in connection with your True Link accounts ("Account") and your use of our services. Communications include:

We will provide these Communications to you by posting them on the True Link website and/or by emailing them to you at the primary email address listed in your True Link profile.

Hardware and software requirements

In order to access and retain electronic Communications, you will need the following computer hardware and software:

We will notify you if there are any material changes to the hardware or software needed to receive electronic Communications from True Link. By giving your consent you are confirming that you have access to the necessary equipment and are able to receive, open, and print or download a copy of any Communications for your records. You may print or save a copy of these Communications for your records as they may not be accessible online at a later date.

How to withdraw your consent

You may withdraw your consent to receive Communications electronically by writing to us at "True Link Financial, Inc. Attn: E-Sign, 315 Montgomery Street Fl. 10, San Francisco, CA 94104", or by contacting us via the "Contact Us" link at the bottom of each page of the True Link website. If you fail to provide your consent, or if you withdraw your consent to receive Communications electronically, True Link reserves the right to either deny your request for an Account, restrict or deactivate your Account, close your Account, or charge you additional fees for paper copies.

Requesting paper copies of electronic Communications

If, after you consent to receive Communications electronically, you would like a paper copy of a Communication we previously sent you, you may request a copy within 180 days of the date we provided the Communication to you by contacting us as described above. We will send your paper copy to you by U.S. mail. In order for us to send you paper copies, you must have a current street address on file as your “Home” address in your True Link profile. If you request paper copies, you understand and agree that True Link may charge you a Records Request Fee for each Communication.

Updating your contact information

It is your responsibility to keep your primary email address up to date so that True Link can communicate with you electronically. You understand and agree that if True Link sends you an electronic Communication but you do not receive it because your primary email address on file is incorrect, out of date, blocked by your service provider, or you are otherwise unable to receive electronic Communications, True Link will be deemed to have provided the Communication to you.

Please note that if you use a spam filter that blocks or re-routes emails from senders not listed in your email address book, you must add True Link to your email address book so that you will be able to receive the Communications we send to you.

You can update your primary email address or street address by contacting us at support@truelinkfinancial.com or 877-264-8783. If your email address becomes invalid such that electronic Communications sent to you by True Link are returned, True Link may deem your Account to be inactive, and you will not be able to transact any activity using your True Link Account until we receive a valid, working primary email address from you.

True Link Privacy Policy

Last updated: September 5, 2025See here for the True Link Privacy Policy for Kids.

True Link Privacy Policy

This Privacy Policy explains how True Link Financial, Inc. and its subsidiary, True Link Financial Advisors, LLC (collectively, “True Link", “Company”, "we", “our” or “us”) collects, uses, discloses, and protects personal information through our online services, websites, mobile applications, use of True Link financial services products and the associated software platform, the use of the trust administration software and record-keeping platform, and any other software provided on or in connection with the services and also any and all communications with us via phone, email, text, chat or otherwise (each, a “Service” and collectively, “Services”).

When you use the Services, you consent to our collection, use, disclosure, and protection of information about you as described in this Privacy Policy.

BY ACCESSING OR USING THE SERVICES, YOU AGREE TO THIS POLICY. IF YOU DO NOT AGREE TO THIS POLICY, PLEASE DO NOT USE THE SERVICE(S).

1. Categories of Personal Information Collected.

Personal information is any information that can be reasonably used to identify you. Personal information does not include de-identified, anonymized, or aggregated information, publicly available information made lawfully available, or any other information excluded from the scope of applicable privacy laws.

We may process the following categories of personal information in connection with our Services:

- Identifiers, including name, email address, postal address, telephone number, Internet Protocol address, online identifiers, account name, Social Security Number, driver’s license or state identification card number, bank account number, or other similar identifiers.

- Commercial information, including assets owned, sources of assets, products or services purchased, merchants paid, or other purchasing or consuming histories, and securities transactions.

- Internet or other electronic network activity information, including browsing history, search history, and information regarding a consumer’s interaction with an internet website, application, or advertisement; and communications that we exchange with you, including when you contact us with questions or feedback, through the Service (including our chatbot and other interactive features), social media, survey participation, text messages, or otherwise.

- Geolocation data, such as data derived from a device that is used to locate an individual within a geographic region (e.g., where the True Link Card has been used).

- Employment information, including professional or employment-related information.

- Inferences, including those drawn from any of the categories of information identified above to create a profile, as well as inferences about an individual’s preference and characteristics.

- Government ID Data, including Social Security number, driver’s license, state identification card, passport number and citizenship status.

- Other information you provide to us, including in reviews, questions, and comments that are shared in a public forum or in response to surveys.

2. Sources from which Personal Information is Collected.

We may collect and store personal information about you from various sources, including, for example, directly from you, automatically through your use of the Service, and from publicly available sources or third parties, as further detailed below.

If you are an individual who utilizes our Services to obtain a financial product or service through us, we will use and share any information that we collect from or about you in accordance with our U.S. Consumer GLBA Privacy Notice. Information subject to our U.S. Consumer GLBA Privacy Notice is referred to as Non-Public Personal Information (“NPPI”).

A. Personal Information Collected From You.

The personal information we collect from you will vary depending on the product or service requested. We may ask for certain personal information such as your username, first and last name, birth date, telephone number, email address, mailing address, social security number, and other details related to your financial situation when you use our Service(s) and/or register for a True Link account. We may also collect personal information that you voluntarily provide to us when using the Service(s).

We may also collect and store personal information that you provide to us about other people. By submitting personal information about someone other than yourself (e.g., a Card Administrator providing information about a Card Owner or Card Holder or a Trustee providing information about a beneficiary), you represent that you are authorized to provide us with that person’s personal information for the purposes identified in this Privacy Policy and in connection with the Service(s).

We may also retain any messages you send through the Service(s), customer service correspondence (via telephone, chat, text, email or otherwise), and may collect personal information you provide or you post to the Service(s).

We also collect communications that we exchange with you, including when you contact us with questions or feedback, through the Service (including our chatbot and other interactive features), social media, survey participation, text messages, or otherwise.

Calls to True Link or to third-parties through True Link by you or to you may be recorded or monitored for quality assurance, customer service, training and/or risk management purposes.

B. Information that is Collected Automatically.

In addition to the personal information you provide to us directly we may automatically collect personal information about your use of the Service(s), as described below.

Log file information. Log file information is automatically reported by your browser each time you access the Service(s). When you use our Service(s), our servers may automatically record certain log file information. These server logs may include information such as your web request, Internet Protocol (“IP”) address, browser type, browser language, operating system, platform type, the state or country from which you accessed the Service, software and hardware attributes (including Device ID), referring/ exit pages and URLs, number of clicks and how you interact with links on the Service, domain names, landing pages, pages viewed and the order of those pages, the data and time you used the Service and uploaded or posted content, error logs, files you download, and other such information.

Location information. When you use the Service, we may automatically collect general location information (e.g., IP address, city/state and or zip code associated with an IP address) from your computer or mobile device.

Use of cookies and other technologies. We use “cookies” and other technologies (such as web beacons and pixels) in connection with our Services. Cookies are small data files that websites place in your browser to recognize your computer or mobile device when you return to the site. These technologies help inform our understanding of user behavior, including for fraud prevention and security purposes, facilitate and measure the effectiveness of advertisements, and give us a better understanding of which parts of our websites people have visited. We may use these technologies when you access our website, e-mails, videos, or advertisements.

Session Replay. We and our vendors may collect information about how you use and navigate the Service(s), in some cases on a real-time basis. This may include information about your browsing behavior, page visits, clicks and cursor movements, searches on our sites, keystrokes, and screen recordings. The information (including your IP address) collected by these technologies will be disclosed to or collected directly by these vendors, who use the information to help us evaluate your use of the Service(s).

C. Information from Third-Party Sources.

We may receive personal information about you from publicly and commercially available sources, as permitted by law, which we may combine with other personal information we receive from or about you. For example, when you open certain accounts at True Link we are legally required to conduct due diligence about who you are. We may provide your personal information to third-party vendors in order to perform this due diligence. We may also acquire your personal information from third-parties.

3. Do Not Track Signals and Similar Mechanisms.

Some Internet browsers may be configured to send “Do Not Track” signals to the online services that you visit. We currently do not respond to “Do Not Track” or similar signals. To find out more about “Do Not Track,” please visit http://www.allaboutdnt.com.4. Use of Your Information.

We may use your personal information for a number of purposes, including:To provide you with and manage the Service(s). We use your personal information to provide, develop, maintain, analyze, and improve our Service(s) and the features and functionality of the Service(s). This may include facilitating your participation in opportunities and promotions, enabling you to make purchases, and the customization and tailoring of the Service(s) features according to the personal information that you provide.

To process and fulfill a request or other transaction submitted to us. We use your information to process or fulfill requests or transactions that you have requested.

To communicate with you. We use the personal information we collect or receive to communicate directly with you, for example, to send you emails containing newsletters, promotions and special offers or send you Service-related emails.

Surveys, offers, sweepstakes. We may use your personal information to conduct surveys, provide you offers or to conduct sweepstakes.

Marketing and advertising. We may use your personal information to market, advertise, and promote our Services and the services of certain third parties we work with.

Research and analytics. We may use your personal information for research and analytical purposes, for example, to identify trends and effectiveness of certain marketing campaigns we run.

Business operations. We may use your personal information for certain operational purposes including, for example, to perform audits and quality control.

To protect the rights of True Link and others. We may use your personal information as we believe is necessary or appropriate to protect, enforce, or defend the legal rights, privacy, safety, security, or property of True Link, its employees or agents, or other users and to comply with applicable law.

For legal reasons and policy compliance. We may use your personal information to comply with obligations under applicable law and to respond to legal process, to investigate or participate in any adversarial legal proceedings, to enforce or investigate violations of our terms or policies, and to investigate or monitor any alleged illegal activities in connection with our Services.

With your consent. We may otherwise use your personal information with your consent or at your direction.

5. Disclosuire of Your Personal Information.

We may disclose your personal information as listed below.Card Administrators, Caretakers, Representative Payees, Trustees, Guardians, Conservators and others who are similarly situated (collectively, "Your Representatives"). Your Representative is the person or organization that has established a True Link account for you and manages that account on your behalf. Your Representative provides us certain information about You to open a True Link account, and we may disclose your information to allow Representatives to manage your account. Personal information you submit to Your Representative through the service also may be governed by Your Representative’s privacy and security policies. For details of these policies, please consult the policies of the Representatives directly.

Affiliates. We may disclose personal information to our parent and subsidiary companies and affiliates including for the purposes and uses described in this Privacy Policy.

Venders. We may disclose your personal information with vendors and other entities who work on behalf of, or with us, such as processors, banks, brokers, agents and other representatives. Vendors assist us with a variety of functions to meet our business operations needs and perform our Services. This includes, for example, assisting with customer service-related functions, providing advertising and analytics services, helping us verify your identity, communications services, providing website hosting services, providing additional financial services like ACH processing, securities trades, bank accounts, check processing, assisting with auditing functions, and helping us with marketing and related research activities.

Marketing partners. We may disclose your personal information with third-party marketing partners including partners who we conduct joint-marketing activities with or who we offer a co-branded service with. Marketing partners also include those entities who maintain a link to our Services on their site, or a True Link widget on their site, when you interact with that widget or click from their site to our Services.

Other parties when required by law or as necessary to protect our users and services. True Link may disclose your personal information where required to do so by law or subpoena or if we reasonably believe that such action is necessary to (a) comply with the law and the reasonable requests of law enforcement; (b) enforce our terms and policies or to protect the security or integrity of our Service; and/or (c) exercise or protect the rights, property, or personal safety of True Link, our Users or others.

Business transfers or corporate transactions. If we are involved in strategic transactions including any sale, divestiture, merger, acquisition, joint venture, assignment, transfer, reorganization, dissolution, bankruptcy or receivership, or similar transactions or proceedings involving all or a portion of True Link (including any share of True Link) or products, services, or other assets, we may disclose personal information in the diligence process with counterparties and others assisting with the transaction and transferred to a successor or affiliate as part of that transaction along with other assets.

Public Forums. Any information or content that you voluntarily disclose for posting to the Service becomes available to the public, as controlled by any applicable privacy settings. Subject to your profile and privacy settings, any personal information that you make public is searchable by other Users. If we remove personal information that you posted to the Service, copies may remain viewable in cached and archived pages of the Service, or if other Users have copied or saved that information. We are not responsible for the information that you choose to submit. or post in public forums.

Otherwise with your consent or at your direction. In addition to the disclosures described in this Privacy Policy, we may share personal information about you with third parties whenever you consent to or direct such sharing.

6. How We Store and Protect Your Information.

True Link takes technical and organizational measures to protect your data against accidental or unlawful destruction or accidental loss, alteration, unauthorized disclosure or access. These measures vary depending on the sensitivity of the personal information we have collected from you. However, no method of transmission over the Internet or via mobile device, or method of electronic storage, is absolutely secure. Therefore, while we strive to use commercially acceptable means to protect your personal information, we cannot guarantee its absolute security. True Link is not responsible for the functionality or security measures of any third-party. To protect your privacy and security, we take steps (such as requesting a unique password) to verify your identity before granting you access to your account. You are responsible for maintaining the secrecy of your unique password and account information, and for controlling access to your email communications from True Link, at all times. Do not share your password with anyone and do limit your access to your computer or other devices by signing off after you have finished accessing your account.

For information about how to protect yourself against identity theft, please refer to the Federal Trade Commission’s website at www.ftc.gov/news-events/media-resources/identity-theft-and-data-security.

To find out more about True Link's security measures, visit our security page.

7. Your Choices and Rights.

A. Your Account Information and Settings.

If you would like to make any changes to your account information, please contact us at support@truelinkfinancial.com.

B. Email Promotions.

You can stop receiving promotional email communications from us by clicking on the “unsubscribe link” provided in such communications. We make every effort to promptly process all unsubscribe requests. You may not opt out of Service-related communications (e.g., account verification, transaction-related updates, changes/updates to features of the Service, and technical and security notices). If you have any questions, you can contact us directly at marketing@truelinkfinancial.com.

C. Cookies.

Blocking cookies in your browser. Most browsers let you remove or reject cookies, including cookies used for interest-based advertising. To do this, follow the instructions in your browser settings. Many browsers accept cookies by default until you change your settings.

Blocking advertising ID use in your mobile settings. Your mobile device settings may provide functionality to limit use of the advertising ID associated with your mobile device for interest-based advertising purposes.

Google Analytics. You can also opt out of Google Analytics by downloading and installing the browser plug-in.

Advertising industry opt out tools. You can also use these opt out options to limit use of your information for interest-based advertising by participating companies:

Note that you will need to opt out on every browser and device that you use because these opt out mechanisms are specific to the device or browser on which they are exercised.

D. Your Privacy Rights.- U.S. Federal Law.

Federal law provides consumers and customers, as those terms are defined in the Gramm-Leach-Bliley Act (“GLBA”), the right to limit some but not all sharing of their information by financial institutions like True Link. Federal law also requires that we inform you how we collect, share, and protect your personal information. Please refer to our U.S. Consumer GLBA Privacy Notice for more information on your rights pertaining to the sharing of NPPI.

- Rights and additional information under applicable U.S. state laws, including Minnesota, and Oregon.

Depending on your jurisdiction, and subject to certain exceptions and restrictions, you or your authorized agent may exercise the privacy rights listed below by following the process outlined in Section 8. If you are a California resident, please see Section 12.

Right to Access / Request to Know. You may have the right to request access to your personal information and receive it in a portable and machine-readable format. This right includes the ability to check whether we process personal information about you. Additionally, under certain state laws, including Oregon and Minnesota laws, you may also request that we disclose to you the third parties to whom we have disclosed your personal information.

Right to Delete. You may have the right to request deletion of your personal information, including your account. However, this may impact your use of our Services.

Right to Correct. You may have the right to correct or update personal information that we hold about you.

Right to Appeal. You may have the right to appeal decisions that we make with regards to a privacy request.

Right to Opt-Out of Selling or Sharing for Targeted Advertising. You may have the right to opt out of targeted advertising and “selling” of personal information, as explained in the “Exercising Your Privacy Rights” section below.

8. Exercising Your Privacy Rights.

To submit a request to know, access, delete, or correct your personal information, or appeal a decision we’ve made regarding a privacy request, please contact us at support@truelinkfinancial.com or by phone at 1-855-244-1209.

All privacy rights requests will be honored within forty-five (45) days of receipt, unless we are unable to process your request in such a time in which case we will provide you with an explanation for the delay. We may deny your request if we cannot verify your identity or if an exception, exemption or restriction applies.

Right to appeal. If you are a resident of Oregon or Minnesota, you may appeal a refusal of a privacy rights request by responding to the notification of denial within 14 calendar days of the date of notification. We will approve or deny the appeal within 45 days after the date on which we receive the appeal and will notify you in writing of our decision and the reasons for the decision. If we deny the appeal, the notice will also provide or specify information that enables you to contact your state attorney general to submit a complaint.

Verification. Once you submit a request, we will verify that you are the consumer to which the request pertains by matching your name, email address and physical address with information we maintain. Depending on the type of request you submit, we will attempt to match either two or three of these data points to the information maintained in our systems. If we are unable to verify your request with the data points you provided, we may reach out to you for additional information to verify your request. We may also reach out to you for additional verifying information for requests requiring a higher degree of verification because of the type or sensitivity of the request. In some instances, we may not be able to honor your request, such as when an exception applies or when we cannot verify your identity.

Exceptions and exemptions. Most state privacy laws do not apply to certain personal information, such as information subject to the Fair Credit Reporting Act (“FCRA”), the Driver’s Privacy Protection Act of 1994, or the GLBA (or any state-specific analogues of the GLBA, such as the California Financial Information Privacy Act (“FIPA”)).

Opting out of Selling or Sharing for Targeted Advertising. We may disclose personal information, including personal information collected through cookies and other technologies, to create, deliver, and measure the effectiveness of advertisements for things you might like. This may be considered targeted advertising under applicable privacy laws. To opt out of targeted advertising that uses personal information collected through cookies and other technologies, scroll to the bottom of the page and click “Do not sell or share my information”, then toggle off and click to confirm your choices.

Right to non-discrimination. You have the right to be free from unlawful discrimination for exercising your rights, including in Oregon and Minnesota. Authorized agents. You may designate an authorized agent to submit a request on your behalf. We may require that you provide the authorized agent with written permission to act on your behalf and that you verify your identity directly with us. Alternate format. If you have a disability that prevents or limits your ability to access this Privacy Policy, please email us at support@truelinkfinancial.com or call us at 1-855-244-1209 We will work with you to provide this notice in an alternative format.

9. How Long We Keep Your Personal Information.

True Link retains or stores your information for as long as necessary to achieve the purpose for which it is processed; comply with retention periods established by applicable law; prevent or resolve disputes; enforce our agreements; and for backup, archival, or audit purposes.

10. Minors’ Privacy.

Certain of our Service(s) allow parents to create accounts for their children, including minors under 16 (“Minors”). For those Service(s), we collect information about Minors from their parents and limited personal information from Minors when they use True Link.Information Collected from Parents. For your Minor to access and use True Link, you will be required to create an account for them. When creating an account for your Minor, we may ask that you provide us with your name, date of birth, address, and social security number and the same information for your Minor.

Information Collected from Minors. If a Minor logs in to review their account, we (and in some cases our vendors) collect personal information from the Minor both directly and automatically. More specifically, we collect:

- Authentication Data: the Minor must provide the last four digits of their card, the last four digits of their social security number, and their date of birth to access their account.

- Activity and usage data: persistent identifiers, including cookies, IP addresses, which we use to provide and improve True Link, for error logging, for analytics, and to collect usage information, and information about the Minor’s browser software and operating system, device type, and similar information.

- Customer support inquiries. If the Minor contacts us for customer support, we will collect your child’s basic contact information, and information about the request and its resolution.

How We Disclose Minors’ Information. We may disclose the personal information we collect from Minors as described below:

- Service Providers: We share personal information with third-party service providers, contractors, or agents to assist us in making True Link available or to help us improve our Service, such as by providing database hosting and data storage.

- Business Transaction: In the event of a merger, sale of capital stock or assets, reorganization, capital investment, consolidation or similar transaction (or the due diligence in contemplation thereof) involving True Link, the information we possess, including personal information collected from your Child, shall be transferred as a corporate asset to the acquiring entity.